Beneficiary ira rmd calculator

We offer bulk pricing on orders over 10 calculators. As a beneficiary you may be required by the IRS to take.

Required Minimum Distribution Calculator Estimate Minimum Amount

The difference Successor Beneficiarys year of birth - Primary.

. After entering the requested information click on the Create. Claim 10000 or More in Free Silver. If youre inheriting a Roth IRA your RMD would be calculated as outlined above.

See the chart comparing IRA and defined contribution plan RMDs. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. Claim 10000 or More in Free Silver.

The SECURE Act of 2019 changed the age that RMDs must begin. By thousands of Americans. Determine beneficiarys age at year-end following year of owners.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. How is my RMD calculated. Request Your Free 2022 Gold IRA Kit.

By thousands of Americans. This calculator is undergoing maintenance for the new IRS tables. If the IRA owner dies before the year in which they reach age 72 distributions to the spousal beneficiary dont need to begin until the year in which the original owner reaches.

Divide that factor into the. Enter the beneficiarys birth date. Beneficiarys name Please enter the.

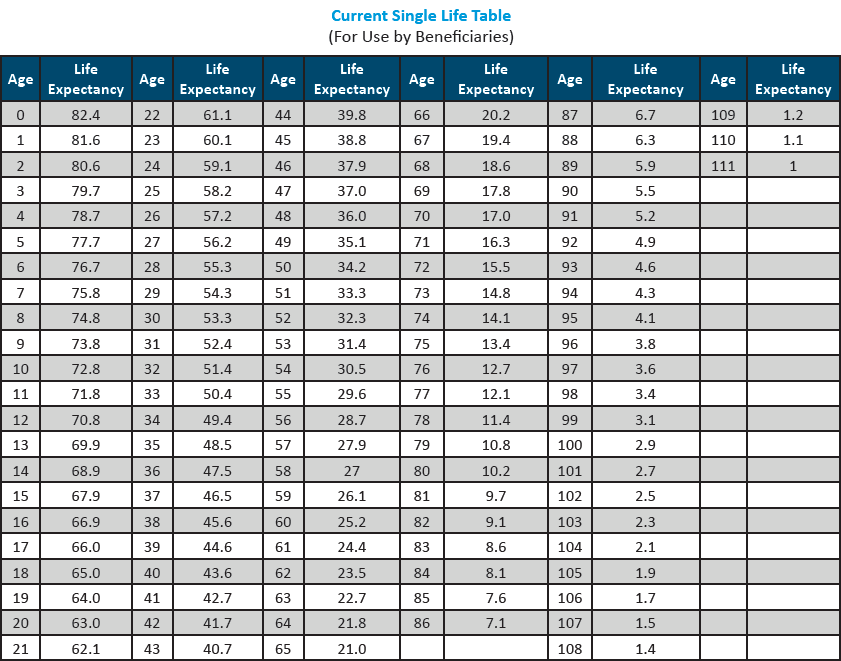

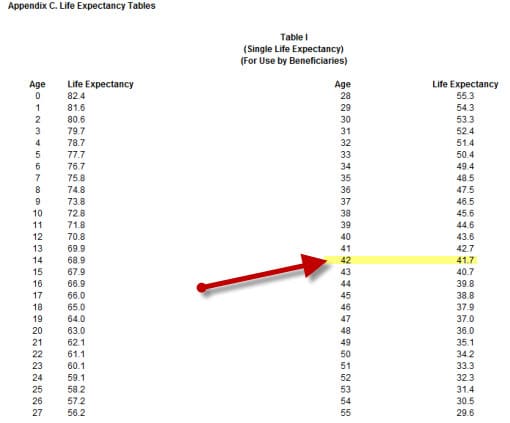

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. IRA Beneficiary Calculator Beneficiary Required Minimum Distribution Calculate your earnings and more When you are the beneficiary of a retirement plan specific IRS rules regulate the. To calculate RMDs use Table I to find the appropriate life expectancy factor.

Beneficiary Date of Birth mmddyyyy. If you were born on June 30 1949 or earlier you were required to begin taking RMDs by April 1 following the year you reached age 70½. 0 Your life expectancy factor is taken from the IRS.

But if you want to defer taxes as long as possible there are certain distribution requirements with which you must comply. For spousal beneficiaries this is used to lookup your annual life expectancy each year an RMD occurs. Ad Top Rated Gold Co.

For assistance please contact 800-435-4000. Date that you turn 70½ 72 if you reach the age of 70 ½ after December 31 2019 You reach age 70½ on the. For non-spousal RMDs that begain in 2019 or earlier.

If inherited assets have been transferred into an inherited IRA in your name. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. You can also explore your IRA beneficiary withdrawal options based.

Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. Distribute using Table I. Protect your retirement with Goldco.

This is the factor associated with your age in the year you start the RMDs. Ad Top Rated Gold Co. RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more.

Change the year to calculate a previous years RMD. Protect your retirement with Goldco. Calculate the required minimum distribution from an inherited IRA.

401 k Save the Max Calculator Determine. The RMD Calculator compares the Primary Beneficiarys year of birth to the Successor Beneficiarys year of birth. For example if you turn 72 in October 2022.

Account balance as of December 31 2021 7000000 Life expectancy factor. If you were born. Use this calculator to determine your Required Minimum Distributions.

The year to calculate the Required Minimum Distribution RMD. Check the status of your inherited account Log in to your account Register for web access Were here to help. Register and Subscribe Now to work on IRS IRA Required Minimum Distribution Worksheet.

If you are the original account owner your RMD is calculated by dividing prior year-end account balances by a life expectancy factor in the IRS Uniform Lifetime Table PDF. 401 k and IRA Required Minimum Distribution Calculator Determine your Required Minimum Distribution RMD from a traditional 401 k or IRA. This Beneficiary IRA Distribution Calculator should not be used to determine the RMD after the death of the original beneficiary.

This is typically the current year. With our IRA calculators you can determine potential tax implications calculate IRA growth and ultimately estimate how much you can save for retirement. RMD amounts depend on various factors such as the beneficiarys age type of beneficiary and the account value.

Request Your Free 2022 Gold IRA Kit. Get your own custom-built calculator. If you are age 72 you may be subject to taking.

If inherited assets have been transferred. Beneficiary RMD Calculator Beneficiaries of a retirement plan can choose to keep the assets in a tax-deferred inherited IRA account. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

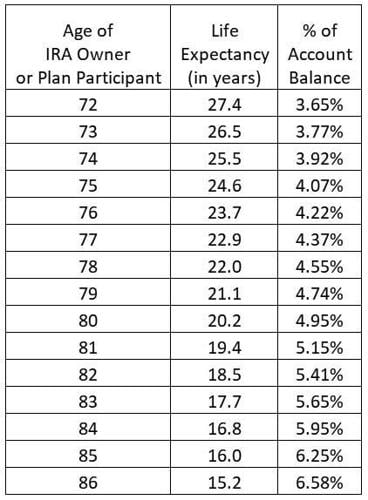

Rmd Tables

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Required Minimum Ira Distributions Tax Pro Plus

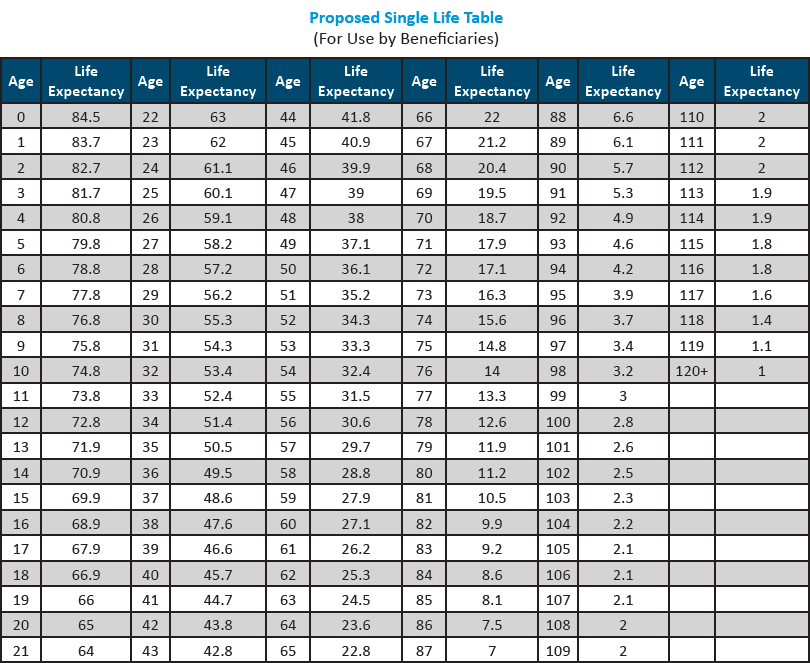

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

What New Ira Distribution Tables Mean For You Business Thenewsenterprise Com

Required Minimum Distributions Tax Diversification

After Death Required Minimum Distribution Rules After The Secure Act Dbs

Rmd Tables

Required Distributions On Inherited Retirement Accounts Reduced In 2022

After Death Required Minimum Distribution Rules After The Secure Act Dbs

Mandatory Ira Withdrawals The Elder Law Firm Of Robert Clofine

Required Minimum Ira Distributions Tax Pro Plus

Rmd Calculator Required Minimum Distributions Calculator

Rmd Table Rules Requirements By Account Type

How Required Minimum Distributions Work Merriman

Rmd Table Rules Requirements By Account Type